Macro conditions, low correlation and…Ian: three reasons to invest in ILS

- Inherent features of insurance-linked securities (ILS) make them a good interest rate and inflation hedge

- Their low correlation with traditional asset classes is highly valuable in this volatile market environment

- The spreads offered in the ILS market increased significantly in 2022, creating a compelling entry or reinforcement point for investors

A useful hedge against rising interest rates and inflation

Inflation, rate hikes and their effect on the cost of capital are driving profound changes in traditional bond and equity markets. The regime change from ‘lower-for-longer’ to stubbornly high inflation has disrupted markets.

However, the insurance-linked securities (ILS) market has been relatively immune to interest rate movements because ILS are floating-rate notes. While inflation does increase the underlying risk borne by ILS investors, for example through the higher cost of replacement material, there are often mechanisms to limit the impact of increased claim amounts. And when this is not the case, ILS managers raise their spread expectations to compensate investors for the incremental risk. The spread of ILS instruments is therefore mostly driven by the market’s view on the underlying insurance risk taken.

This combination of the floating-rate component and the controlled sensitivity to inflation (either through inherent mechanisms in underlying policies or via spread expectations) make ILS an attractive diversifier in an environment of persistently rising prices and interest rates.

Low correlation to other asset classes

The performance of ILS is tied to the occurrence of catastrophic natural disasters and largely independent from movements in financial markets. It’s not surprising, then, that ILS are hardly correlated to traditional markets.

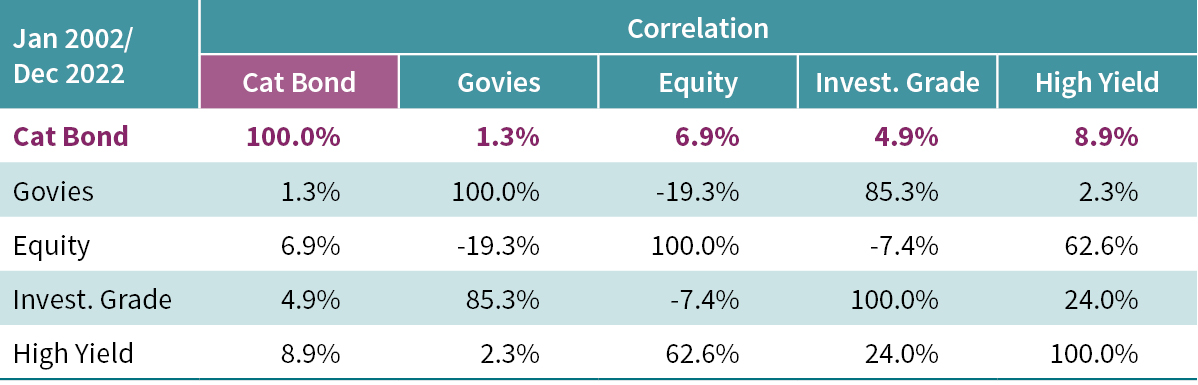

As the table below shows, correlations with traditional asset are banded close to 0%, which has made ILS an attractive option for investors seeking to diversify and improve the risk/return profile of their portfolios. These low correlations were highly valuable to investors during the market turmoil caused by Covid-19 in 2020 and more recently by the war in Ukraine. ILS has been one of the few relatively liquid and performing asset classes in most investment portfolios.

Figure 1: Correlations between various asset classes (Jan 2002-Dec 2022)

Source: AXA IM, January 2023

Hurricane Ian and widening spreads

The traditional reinsurance markets have seen an upwards pricing pressure from different factors including above-average natural catastrophe losses in the last few years (from Ida, Uri and secondary perils in 2021 to hurricane Ian more recently).

On the one hand, this has pushed insurers and reinsurers to extend their usage of alternative capacity to find reinsurance coverage. On the other hand, the available capacity and demand from many of ILS’s traditional investors has reduced significantly.

An underlying consideration is climate change, a long-term trend which might affect the frequency or the severity of large catastrophic events. However, ILS are typically short-maturity instruments with risk re-evaluated every year. Any incremental increase in the underlying risk will be taken into account either by reducing exposure to assets most at-risk or by pricing it into the offered spreads.

Because of these factors, ILS investors can expect much higher returns than last year for a given level of risk.

An attractive entry or reinforcement point

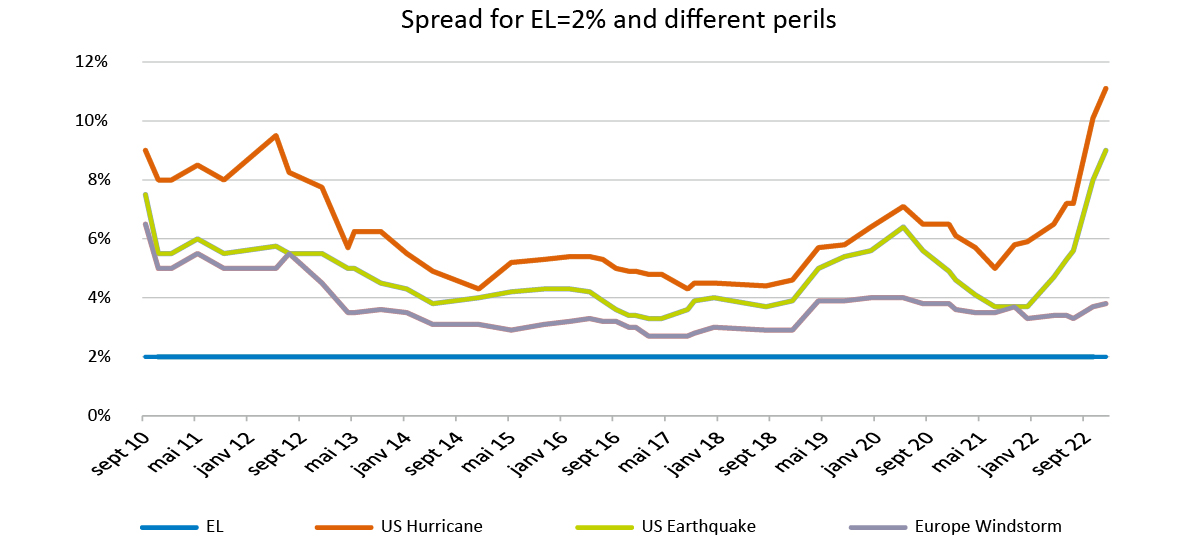

This scarcity of reinsurance capital has already caused a significant increase in spreads for new ILS issuances. As the graph below shows, there has been an ongoing trend of spread increase since the second quarter of 2022, recently exacerbated by hurricane Ian.

Primary issuances post-Ian show significantly higher spread guidance ranges compared to those offered for similar layers/deals issued by sponsors in 2021. For example, the average spreads paid by sponsors for a US hurricane or an earthquake-exposed transaction with a 2% expected loss moved respectively from 6% and 4% to 11% and 9%.

Figure 2: Spreads offered on Cat bonds exposed to various perils for a 2% expected loss

Source: AXA IM, January 2023

Selection remains key

The ILS asset class is innovative and growing. The breadth of covered perils is increasing, with a marked expansion outside purely catastrophic risks. Total market size is in excess of USD 95bn, providing investors with a broad pool of opportunities.

But this broader set of opportunities brings a wider set of considerations and a greater need for skill and experience when selecting investments. Larger investors tend to have to ‘buy the market’. By contrast, our size allows us to adopt a highly selective investment approach, driven by disciplined underwriting and based on fundamental research. Selecting only well-structured deals and controlling our exposure to risks such as hurricanes in Florida can help avoid losses on past events and geographies with a higher probability of catastrophe.

Disclaimer

All data sourced by AXA IM Alts as at January 2023

This message is for distribution to institutional and professional clients only and is not intended for retail customer use. This message is for informational purposes only and does not constitute, an offer to buy or sell, solicitation, recommendation or investment advice. It has been established on the basis of data, projections, forecasts, anticipations and hypotheses which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

The information contained in this message is not based on the particular circumstances of the recipient. This message does not take into account the recipient’s objectives, financial situation or needs.

Furthermore, due to the subjective nature of these analysis and opinions, these data, projections, forecasts, anticipations, hypothesis and/or opinions are not necessary used or followed by AXA IM Alts’ management teams or its affiliates, who may act based on their own opinions and as independent departments within the Company.

This message may also contain historical market data; however, historical market trends are not reliable indicators of future market behaviour.

For illustrative purposes only. There can be no guarantee that any investment strategy described will be implemented or ultimately be successful. All information in this message is established on data made public by official providers of economic and market statistics.

By accepting this message, the recipient agrees that it will use the information only to evaluate its potential interest in the strategies described herein and for no other purpose and will not divulge any such information to any other party.

AXA IM Alts disclaims any and all liability relating to a decision based on or for reliance on this message.

Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM Alts, prohibited.

© 2023 AXA IM Alts and its Affiliated Companies. All rights reserved.

AXA IM and BNPP AM are progressively merging

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.