Significant Risk Transfer: poised for further growth

- 04 July 2023 (7 min read)

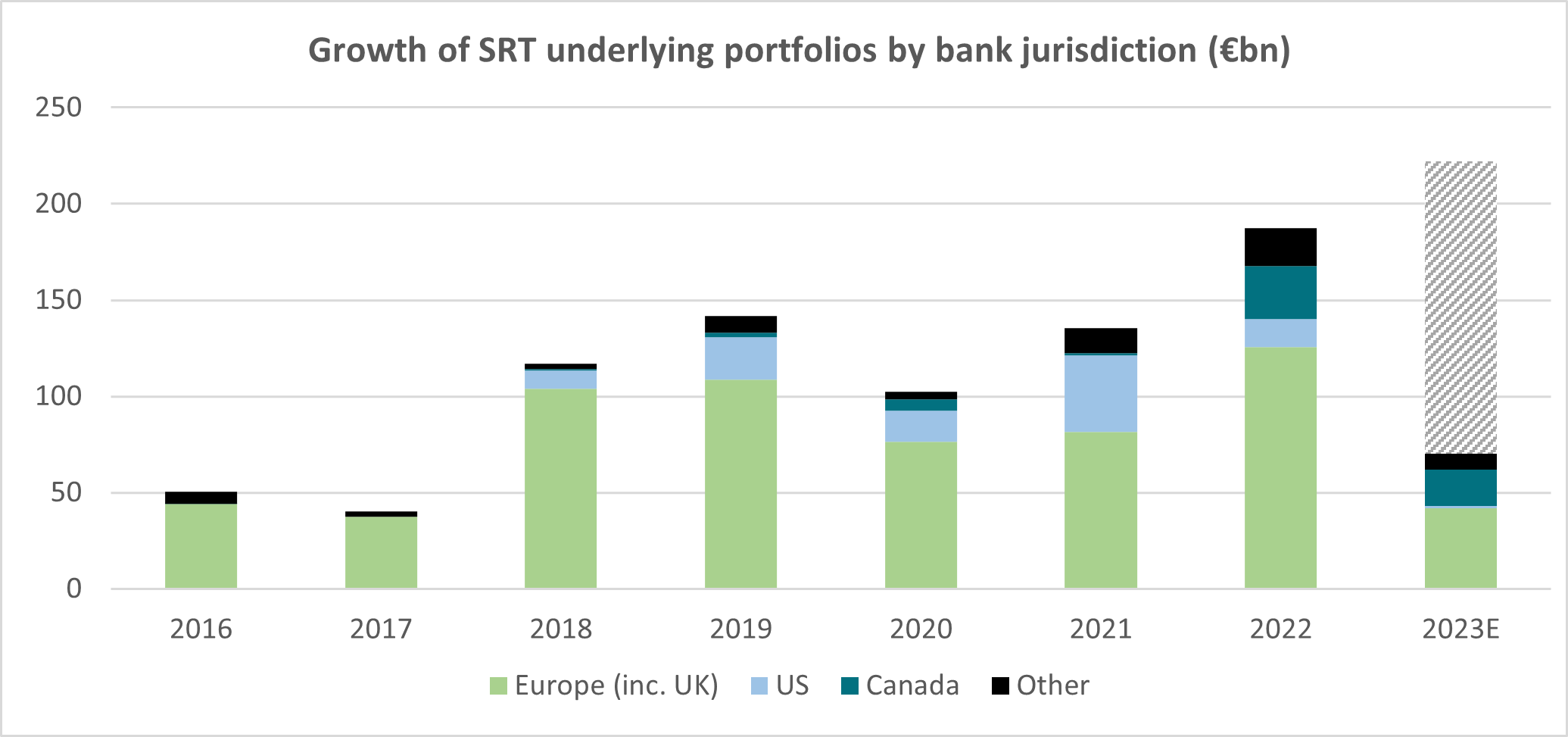

Recent market events have brought bank exposure into sharp focus for investors. However, one area of bank lending which stands to benefit from the turmoil is significant risk transfer (SRT). This is a market that has been growing rapidly – having doubled in size since 2016 – and is likely to undergo accelerated growth because of the disruption to the way banks raise capital.

SRT transactions give investors the opportunity to access banks’ core performing loans at attractive spreads. Investors receive a premium from the bank for bearing the credit risk from the selected portfolio of loans. The structuring and the diversification of underlying loans make them a resilient investment vehicle, typically with exposure to:

- High-quality (IG), performing portfolios

- Low-levered companies, helping to avoid market liquidity risk

- Diversified exposures across different types of risks – e.g. US large corporates, French mid-caps, German SMEs, Infrastructure and Commercial Real Estate

Why the SRT market has been growing

Most banks have had to meet tougher Core Tier 1 capital, leverage and liquidity requirements since the global financial crisis. They have several ways of increasing their core capital, which helps to improve their balance sheets and profitability. One is by issuing equity, although these are difficult market conditions for banks to approach investors. Another is issuing AT1s, a type of ‘contingency’ bond that can be converted to equity if the bank’s capital levels fall below their required level. However, investors have grown nervous of this capital instrument following the treatment of AT1s during the collapse of Credit Suisse.

Another route is SRT, which is increasingly being used by banks to raise regulatory capital. This helps explain why the market has been growing not only in terms of value but also the increased regional diversity of participating banks. In our view, banks will continue to use SRT as an efficient instrument to generate capital relief.

Source: AXA IM Alts as of 31 May 2023

Why SRT is potentially attractive for investors

- The spread above floating rate has historically been in the high single digits – and given the higher cost of capital and pressure on banks, the direction of spreads over the past year has been upwards.

- They provide immediate, stable cash flows. Cash flows are based on premiums paid by the bank, not from the referenced loan portfolio. The risk of the loans may however change throughout time and the nominal value and cash flows could be impacted if a loan defaults.

- Investors benefit from banks’ experience in managing recoveries in case of a credit event, as the banks remains incentivised to lower the impact of defaults.

- The referenced loans portfolio in an SRT transaction – already highly diversified itself – can help diversify an investor’s existing credit portfolio across sectors, geographies, seniority and borrowers.

- In particular, the loans pool gives investors the opportunity to access core bank performing assets which may be not accessible through public market or direct lending. It also gives access to a relatively closed and relationship-driven SME lending market.

How SRT works

A SRT transaction involves a bank, a book of performing loans and an investor willing to sell default protection for a selected portion of that loan book. SRT transactions give investors the opportunity of focused access to banks’ core performing assets, without exposure to the broader credit risk of the banks. The portfolio of loans reflects the bank’s core lending and there are three important points to bear in mind:

- The SRT market is built on partnership between the banks and investors. It is in banks’ interest to maintain healthy loan portfolios a) to encourage healthy SRT demand from investors and b) because banks retain a minimum 5% of each loan and are responsible for originating, servicing and working out any potential defaults.

- SRT transactions give investors focused access to banks core performing assets. There is no exposure to the broader credit risk of the bank and a fund manager can tailor the book of loans to their specific requirements by, for example, adding ESG or credit rating exclusions. And in the current environment of higher spreads investors can negotiate stricter terms, insisting on more risk-averse structures as well as greater stringency on the types of credits included in the underlying portfolios.

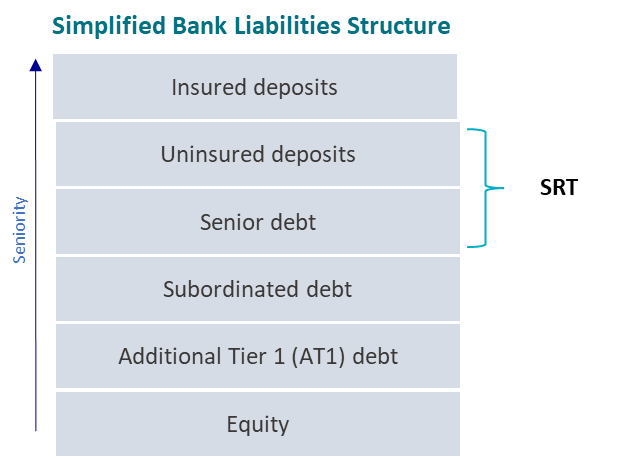

- The SRT transaction is not part of the bank’s liabilities. SRTs are not part of the ‘capital stack’. They are a credit hedge that references a specific portfolio on the bank’s balance sheet. The ‘protection’ provided for those loans comes in the form of collateral which can be posted either with the issuing bank or a third-party bank. This SRT collateral is akin to senior-ranked debt or uninsured deposits and is expected to rank above equity, AT1s and other debt held by the bank.

Source: AXA IM Alts. For illustrative purposes only.

SRT trades don’t bear the same regulatory/bail-in risk as Equity or AT1 and SRT collateral proceeds are expected to rank above: equity, AT1, Lower T2, HoldCo Senior Debt/Non-Preferred Senior Debt.

It is also worth bearing in mind that SRT transactions have been encouraged and increasingly standardised by regulators. The European Banking Authority has been at the forefront of these developments and in 2020 released a framework for SRT transactions. A framework for US banks is expected by the end of 2023.

The SRT market continues to grow

In our view, SRTs have proven their robustness, providing stability and attractive risk-adjusted returns through 20 years of varying market conditions. Backed by regulatory support for risk-sharing between banks and capital markets, the quality and diversification of underlying loan portfolios and the recent widening of spreads for SRT transactions offer potentially compelling risk-adjusted returns to investors.

It also offers the opportunity for investors to diversify their credit exposure, which is further strengthened by increased bank participation. All these factors combined leads us to believe that the SRT market will continue to grow and give investors the opportunity to access appealing premiums and an important source of diversification, which in the current market environment is more important than ever.

Disclaimer

All data sourced by AXA IM Alts as at March 2023

This message is for distribution to institutional and professional clients only and is not intended for retail customer use. This message is for informational purposes only and does not constitute, an offer to buy or sell, solicitation, recommendation or investment advice. It has been established on the basis of data, projections, forecasts, anticipations and hypotheses which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

The information contained in this message is not based on the particular circumstances of the recipient. This message does not take into account the recipient’s objectives, financial situation or needs.

Furthermore, due to the subjective nature of these analysis and opinions, these data, projections, forecasts, anticipations, hypothesis and/or opinions are not necessary used or followed by AXA IM Alts’ management teams or its affiliates, who may act based on their own opinions and as independent departments within the Company.

This message may also contain historical market data; however, historical market trends are not reliable indicators of future market behaviour.

For illustrative purposes only. There can be no guarantee that any investment strategy described will be implemented or ultimately be successful. All information in this message is established on data made public by official providers of economic and market statistics.

By accepting this message, the recipient agrees that it will use the information only to evaluate its potential interest in the strategies described herein and for no other purpose and will not divulge any such information to any other party.

AXA IM Alts disclaims any and all liability relating to a decision based on or for reliance on this message.

Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM Alts, prohibited.

© 2023 AXA IM Alts and its Affiliated Companies. All rights reserved.