From reset to opportunity: Alternative Credit markets in 2023

- 31 January 2023 (5 min read)

It goes without saying that last year was difficult for all investors. But it is likely 2022 will be remembered as a transitional year as we move from a phase of extreme lows to one of higher inflation, higher yields and slower growth.

Uncomfortable as 2022 was for investors, it brought a reset of pricing in markets which gives grounds for optimism in 2023. Easing inflation and slower growth should mean a less aggressive approach from central banks, albeit that they may be hawkish for longer than markets are currently pricing. 2023 shows signs of being a year of consolidation, even against the background of ongoing geopolitical risks and a difficult macroeconomic environment.

Defaults and downgrades – back to the ‘old normal’

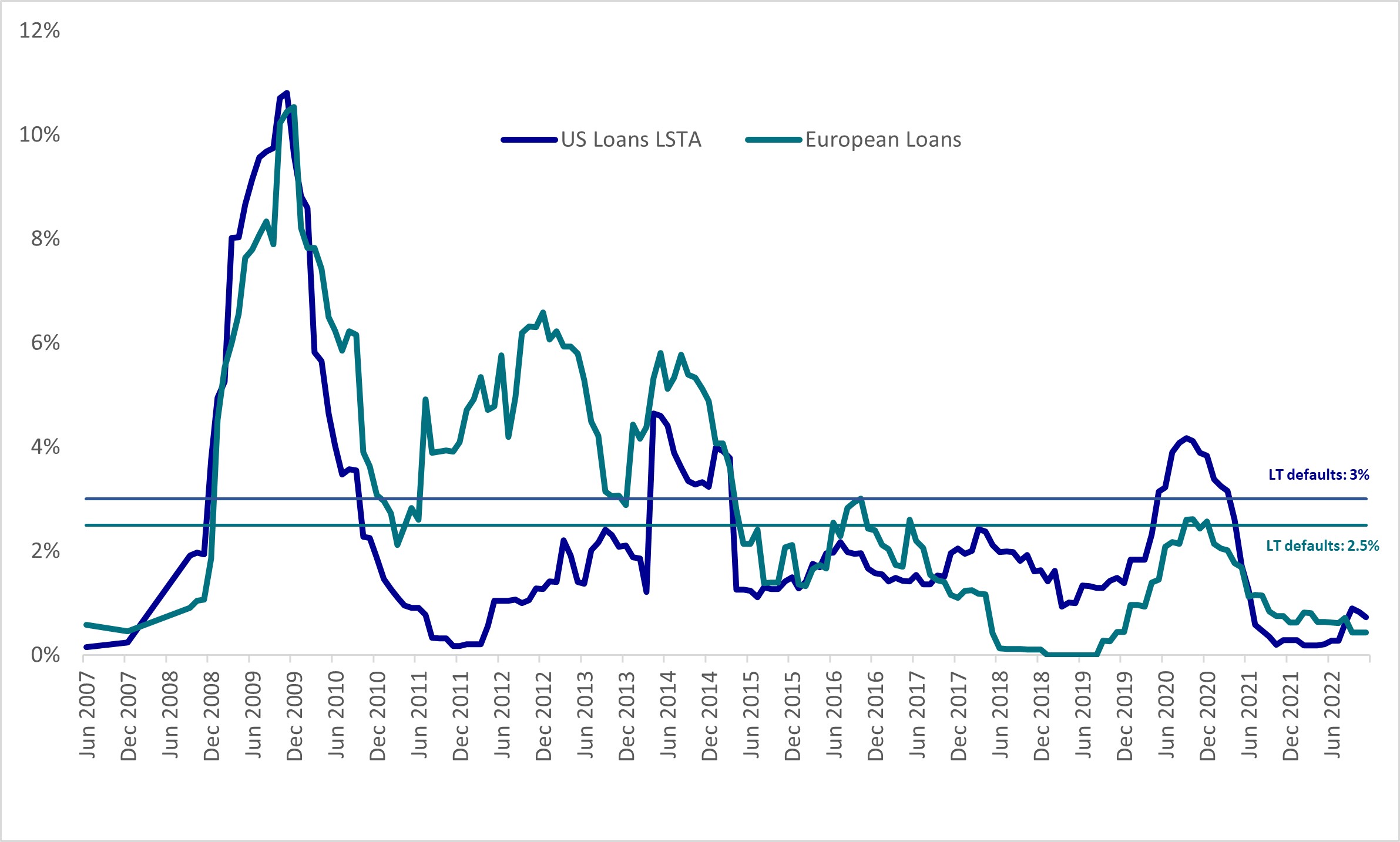

The reset of pricing in 2022 means that Alternative Credit assets have returned to appealing levels versus their long-term history. Spreads were pushed wider by the market uncertainty of 2022 but may end 2023 slightly tighter, despite the consequences of economic slowdown. Those consequences? Defaults and downgrades, which are likely to move back to their long-term averages from recent historical lows.

Default rates of global secured loans

Source: AXA IM, Morningstar European Leveraged Loan Index (ELLI) and Morningstar LSTA US Leveraged Loan Index (LLI)

This will bring increased price dispersion, and it will mean it’s time for fund managers to prove their worth. Those with strong, disciplined credit selection will identify and capture opportunities that differentiate their performance.

Loans offer an attractive entry point

We see opportunities developing in the loans market where client demand will help support prices and liquidity. Very simply put, the widened spreads offer an attractive entry point for a selective investor. So what about the risks? Fears about the maturity wall are premature, with data from JP Morgan showing a peak in loan maturities from 2025 to 2028.

The other concern, as mentioned above, is defaults. These will rise as some companies struggle with increased costs and the effects of monetary policy on demand. We believe, however, that this rise in defaults will only reach long-term averages of around 3%. Companies with strong cashflows and the ability to pass on inflation should continue to fare well. And while inflation is the bane of a company’s working capital, it should be remembered that it also erodes the real value of existing debt and loan repayments.

Significant Risk Transfer

Another area of opportunity – especially for those seeking to diversify their returns – is significant risk transfer (SRT), also known as Regulatory Capital. These are loans originated and managed by banks. Portions of these loans are credit guaranteed or ‘insured’ in return for high single-digit and sometimes low double-digit returns. They reflect lending to the real economy on core, performing companies and are very resilient to credit cycles.

Insurance-Linked Securities offer ultra-low correlations

Finally, developments in the Insurance-Linked Securities (ILS) market mean that they present an attractive entry point. As François Divet explains in this piece, ILS offer very low correlations to traditional markets while also helping to hedge against any further interest rate increases.

Many reasons for optimism

It may appear strange to find a head of asset class so optimistic after a tough 2022. But we are returning to an environment in which higher dispersion in markets provides an opportunity to deliver strong performance in selected asset classes. This, combined with underlying strategies that have been relatively resilient through Covid and 2022, gives me confidence that they will continue to play a key role in providing diversified returns for clients.

Disclaimer

All data sourced by AXA IM Alts as at January 2023

This message is for distribution to institutional and professional clients only and is not intended for retail customer use. This message is for informational purposes only and does not constitute, an offer to buy or sell, solicitation, recommendation or investment advice. It has been established on the basis of data, projections, forecasts, anticipations and hypotheses which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

The information contained in this message is not based on the particular circumstances of the recipient. This message does not take into account the recipient’s objectives, financial situation or needs.

Furthermore, due to the subjective nature of these analysis and opinions, these data, projections, forecasts, anticipations, hypothesis and/or opinions are not necessary used or followed by AXA IM Alts’ management teams or its affiliates, who may act based on their own opinions and as independent departments within the Company.

This message may also contain historical market data; however, historical market trends are not reliable indicators of future market behaviour.

For illustrative purposes only. There can be no guarantee that any investment strategy described will be implemented or ultimately be successful. All information in this message is established on data made public by official providers of economic and market statistics.

By accepting this message, the recipient agrees that it will use the information only to evaluate its potential interest in the strategies described herein and for no other purpose and will not divulge any such information to any other party.

AXA IM Alts disclaims any and all liability relating to a decision based on or for reliance on this message.

Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM Alts, prohibited.

© 2023 AXA IM Alts and its Affiliated Companies. All rights reserved.